Not a subscriber? Click here to sign up!

In this issue:

- Summer Renewal Postcard

- IRS Urges "Paycheck Checkup"

- Nearly 2 Million ITINs Expire This Year

- CFS Tip: Field Help

Summer Renewal Postcard

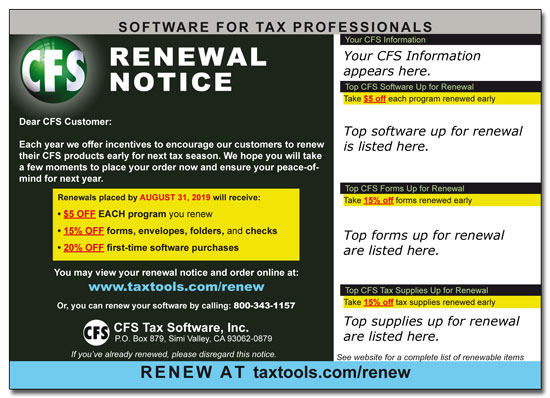

As we explained in April's e-news, due to the complexities caused by new sales tax laws in some states, as of this year we are no longer sending out renewal packets with mail-in order forms. Instead we are sending out renewal reminder postcards, like the one pictured below.

Due to space limitations, some renewal items may not be listed; the postcard is meant as a reminder to check your complete renewal notice online at taxtools.com/renew. Once you're there, it's easy to renew: simply add the items you wish to purchase to your cart and proceed to the checkout; sales tax and shipping will be calculated for you. If you prefer not to order online, you can still renew by phone or print out a form at our website to renew by mail or fax.

Whichever way you decide to renew, be sure to do so by August 31, 2019, for:

- $5 off every program renewed early;

- 20% off the first-time purchase of additional software or network upgrades; and

- 15% off forms, envelopes, folders, and checks.

IRS Urges "Paycheck Checkup"

The IRS is again encouraging taxpayers to check-and if necessary adjust-their paycheck withholding now, in order to "take charge of their tax situation and avoid a surprise at tax time next year."

The agency said the average tax refund was $2,729 for tax year 2018. While some taxpayers may find it advantageous to get a large tax refund, others may wish to have more of their money in their paychecks throughout the year. Whatever the goal, the IRS wants taxpayers to know that while taxes must be paid as income is earned during the year, either through withholding or estimated tax payments, they can make adjustments that will influence the size of their refund. (IR-2019-112.)

We recommend using our W4 Calculator to perform paycheck checkups for all of your clients. W4 Calculator is the perfect tool for adjusting withholding mid-year. You can use it to ensure your clients come as close as possible to breaking even at the end of the year, or you can use it to calculate for a desired refund.

We recommend using our W4 Calculator to perform paycheck checkups for all of your clients. W4 Calculator is the perfect tool for adjusting withholding mid-year. You can use it to ensure your clients come as close as possible to breaking even at the end of the year, or you can use it to calculate for a desired refund.

W4 Calculator calculates W-4 allowances and generates Forms W-4, W-4P, W-4V, 1040-ES, and 540-ES. It calculates state withholding allowances for Arizona, California, Illinois, New Jersey, New York, North Carolina, Ohio, Oregon, South Carolina, and Virginia, and generates state withholding allowance forms for each of those states. It includes our Paycheck Withholding Calculator, Invoice Generator, and Label Maker, and imports clients and preparers from other CFS programs and major tax preparation programs.

The IRS has announced major changes to Form W-4 for next year. If you have W4 Calculator, you will want to make sure you renew early, so you'll have access to the 2020 version as soon as it is released. If you don't have W4 Calculator, now is the best time to buy; you'll get both the current version and the 2020 version for the price of one year-with a 20% discount if you renew your other CFS software by August 31st. Click here to order.

Nearly 2 Million ITINs Expire This Year

In a recent news release, the IRS stated that nearly two million ITINs are set to expire at the end of 2019, and that taxpayers should submit their renewal applications early to avoid refund delays:

"We urge taxpayers with expiring ITINs to take action and renew the number as soon as possible. Renewing before the end of the year will avoid unnecessary delays related to their refunds," said IRS Commissioner Chuck Rettig. "To help with this process, the IRS is sharing this material in multiple languages. We encourage partner groups to share this important information to reach as many people with ITINs as possible."

For more information, see IR-2019-118.

CFS Tip: Field Help

CFS Tip: Field Help

A yellow "Help Panel" appears at the bottom of most input screens in CFS programs. It displays context-sensitive help for whatever field your cursor is in. For example, if your cursor is in a tax ID number field, the panel displays the following prompt:

"Enter the taxpayer's ID number. Select Field Format from the Options menu to change from SSN to EIN."

If you can't see the Help Panel, check your Configuration Options: at the main menu, click "Configuration" on the menu bar; in the "Tools" section under "Form Display Options," the "Help Panel" check box should contain an 'x'. If you make any changes to your Configuration Options, be sure to click the "Save Settings" button.

You can also access field help by pressing the F2 key.

CFS Customer Service

|

Financial Planning Tools '19 & '20 Quick Reference Guide '19 & '20 |

$199 $550 $39 $99 $179 $89 |

To contact us, please click here. To unsubscribe from this service,

type "unsubscribe from enews" in the Comment field.